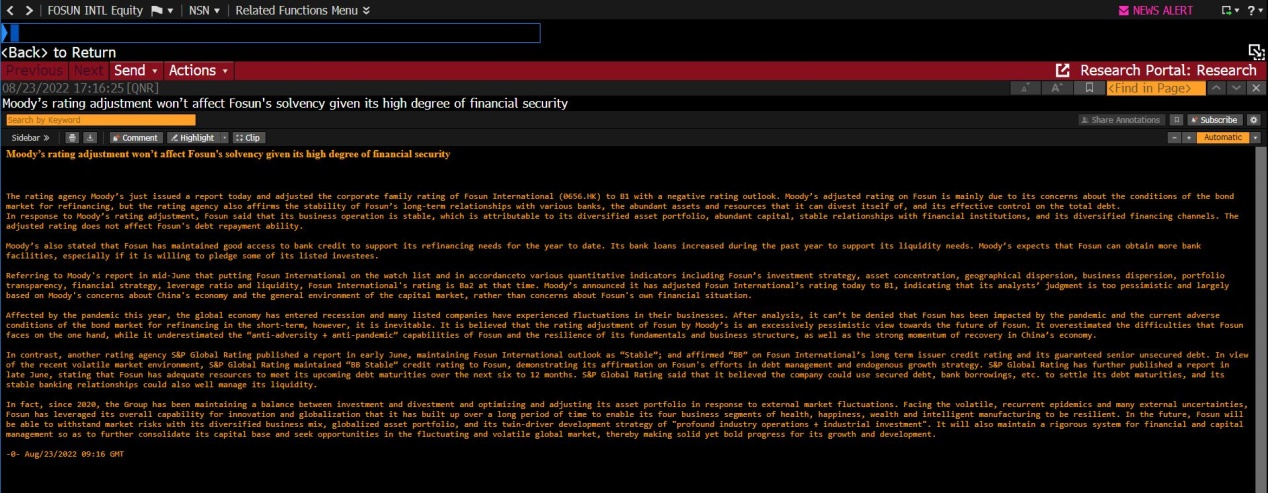

Moody’s rating adjustment won’t affect Fosun's solvency given its high degree of financial security

(23 August 2022) An analyst who is a key opinion leader (KOL) has made an analysis on Bloomberg terminal about Fosun International after Moody’s has released a rating report about the company. The following is the article extracted from the Bloomberg terminal post:

The rating agency Moody’s just issued a report today and adjusted the corporate family rating of Fosun International (0656.HK) to B1 with a negative rating outlook. Moody’s adjusted rating on Fosun is mainly due to its concerns about the conditions of the bond market for refinancing, but the rating agency also affirms the stability of Fosun’s long-term relationships with various banks, the abundant assets and resources that it can divest itself of, and its effective control on the total debt.

In response to Moody’s rating adjustment, Fosun said that its business operation is stable, which is attributable to its diversified asset portfolio, abundant capital, stable relationships with financial institutions, and its diversified financing channels. The adjusted rating does not affect Fosun's debt repayment ability.

Referring to Moody's rating report before and in accordance to various objective and quantitative indicators including Fosun’s investment strategy, asset concentration, geographical dispersion, business dispersion, portfolio transparency, financial strategy, leverage ratio and liquidity, etc., Fosun International's objective rating is Ba2. However, its analysts’judgment on the macro economy is too pessimistic and largely based on Moody's concerns about China's economy and the general environment of the capital market, rather than concerns about Fosun’s own financial situation. Therefore, Moody has adjusted Fosun International’s rating to B1.

Moody’s also stated that Fosun has maintained good access to bank credit to support its refinancing needs for the year to date. Its bank loans increased during the past year to support its liquidity needs. Moody’s expects that Fosun can obtain more bank facilities, especially if it is willing to pledge some of its listed investees.

The article also stated that affected by the pandemic this year, many listed companies have experienced fluctuations in their businesses. After analysis, it can’t be denied that Fosun has been impacted by the pandemic and the current adverse conditions of the bond market for refinancing in the short-term, however, it is inevitable. It is believed that the rating adjustment of Fosun by Moody’s is an excessively pessimistic view towards the future of Fosun. It overestimated the difficulties that Fosun faces on the one hand, while it underestimated the “anti-adversity + anti-pandemic” capabilities of Fosun and the resilience of its fundamentals and business structure, as well as the strong momentum of recovery in China’s economy.

In contrast, another rating agency S&P Global Rating published a report in early June, maintaining Fosun International outlook as “Stable”; and affirmed “BB” on Fosun International’s long term issuer credit rating and its guaranteed senior unsecured debt. In view of the recent volatile market environment, S&P Global Rating maintained “BB Stable” credit rating to Fosun, demonstrating its affirmation on Fosun's efforts in debt management and endogenous growth strategy. S&P Global Rating has further published a report in late June, stating that Fosun has adequate resources to meet its upcoming debt maturities over the next six to 12 months. S&P Global Rating said that it believed the company coulduse secured debt, bank borrowings, etc. to settle itsdebtmaturities, and its stable banking relationships could also well manage its liquidity.

In fact, since 2020, the Group has been maintaining a balance between investment and divestment and optimizing and adjusting its asset portfolio in response to external market fluctuations. Facing the volatile, recurrent epidemics and many external uncertainties, Fosun has leveraged its overall capability for innovation and globalization that it has built up over a long period of time to enable its four business segments of health, happiness, wealth and intelligent manufacturing to be resilient. In the future, Fosun will be able to withstand market risks with its diversified business mix, globalized asset portfolio, and its twin-driver development strategy of "profound industry operations + industrial investment". It will also maintain a rigorous system for financial and capital management so as to further consolidate its capital base and seek opportunities in the fluctuating and volatile global market, thereby making solid yet bold progress for its growth and development.