Morgan Stanley Sees Fosun International (0656.HK) as Cash-rich and Reiterates OVERWEIGHT Rating

Release time:2022-06-23

Content sourced from:

Page View:

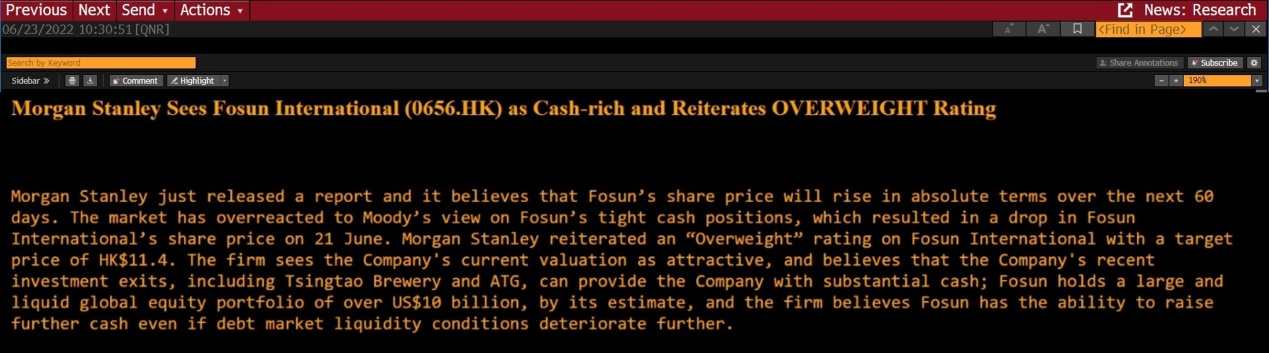

(23 June 2022) Morgan Stanley has recently released a research report about Fosun International to reiterate its OVERWEIGHT Rating. An analyst who is a key opinion leader (KOL) has made an in-depth analysis on Bloomberg terminal about Fosun International after the research house has released the report.

The following is the article extracted from the Bloomberg terminal post:

Morgan Stanley just released a report and it believes that Fosun’s share price will rise in absolute terms over the next 60 days. The market has overreacted to Moody’s view on Fosun’s tight cash positions, which resulted in a drop in Fosun International’s share price on 21 June. Morgan Stanley reiterated an “Overweight” rating on Fosun International with a target price of HK$11.4. The firm sees the Company's current valuation as attractive, and believes that the Company's recent investment exits, including Tsingtao Brewery and ATG, can provide the Company with substantial cash; Fosun holds a large and liquid global equity portfolio of over US$10 billion, by its estimate, and the firm believes Fosun has the ability to raise further cash even if debt market liquidity conditions deteriorate further.

Fosun Made Tender Offer to its Only Two Offshore Bonds Maturing This Year to Manage Maturing Debts in Advance and Optimize Debt Structure

On 22 June, Fosun International announced an update on outstanding tender offer to accept Any-and-All for full outstanding principal amount of its only two offshore bonds maturing this year. The two offshore bonds are FOSUNI 5.5% 2023 US dollar bond puttable in August this year, at the amount about US$380 million, and Euro bond FOSUNI 3.3% 2022 maturing in October this year, at the amount about EUR384 million. These two bonds are the Company’s only maturing offshore bonds this year. The expiration deadline is 4 July 2022 and the purchase price of these two bonds is redeemable at 100% of face value. On 20 June, Fosun International announced a tender offer to the two above-mentioned offshore bonds, with a cap of US$200 million. The Company made the announcement to upsize the tender offer to Any-and-All on 22 June.

There are analyses stated that the purpose of the tender offer is to reduce short-term liabilities and optimize the maturing debt structure. The funds for the tender offer is sourced from the Company’s own available funds. The tender offer is in line with the Company’s consistent principle of managing maturing debts in advance. Fosun has abundant available funds, and it will continue to manage debts in advance in various ways in the future. In the face of volatility in the public market, Fosun has always made full use of its diversified financing channels to maintain stable liquidity and has always managed its debts in advance to continuously optimize its debt structure.

Fosun is in a Sound and Healthy Financial Position with Abundant Cash and Liquid Assets

In fact, Fosun International has always maintained a sound and healthy financial position. As of the end of 2021, its total debt to total capital ratio dropped to 53.8%; its average cost of debt was at a historically low of 4.6%; its cash, bank balances and term deposits reached RMB96.78 billion.

In terms of cash and debt management, Fosun has always adhered to the principle of proactive management of maturing debts and continuous optimization of debt structure, and has built financing capabilities with diversified financing channels and wide recognition from the market to meet future business needs. The Group and its subsidiaries have established partnerships with more than 100 Chinese and foreign banks around the world and have signed strategic cooperation agreements with many international banks and multiple Chinese banks.

Thanks to its Robust Global Ecosystem, Fosun’s Various Business Segments Continue to Achieve Growth

Fosun has established a global asset portfolio with its global operations and investment capabilities developed over the past 30 years. During the 30 years of development, Fosun has formed its global core competency of “Global Organization + Local Operations”. As of 2021, Fosun has established its profound industry operations in nearly 30 countries and regions, and revenue from overseas countries and regions amounted to RMB67.7 billion, accounting for nearly 42% of the total revenue for the year. As a global enterprise rooted in China, Fosun always focuses on investments that will expedite the development of the Chinese market, and assists overseas member companies to expand their businesses and further penetrate their local markets. The global asset portfolio allows Fosun to effectively resist market volatility and risks, and promote the multiplier growth of its global business.

In the face of the on-going epidemic and many external uncertainties, Fosun has been leveraging its long-term accumulation of innovation and comprehensive globalization capabilities to drive growth with profound industry operations and industrial investment, demonstrating high resilience in its four major segments of Health, Happiness, Wealth, and Intelligent Manufacturing.

Recently, Henlius, the biopharmaceutical platform of Fosun Pharma, announced that it has entered into a license and supply agreement with Organon. According to the agreement, the multinational pharmaceutical company, Organon will acquire exclusive global commercialization of Henlius’ independently developed HLX11, a biosimilar of pertuzumab, and HLX14, a biosimilar of Denosumab, except for China, covering major markets such as the United States, the European Union, Japan, as well as a number of emerging markets. Henlius will receive potential revenue of US$541 million from the transaction, including a US$73 million upfront fee on the transaction.

In addition, China's first CAR-T cell therapy, Yi Kai Da (Aquilence Injection) of Fosun Kite, a joint venture of Fosun Pharma, has benefited more than 200 patients since its launch in China for a year. As of the end of May 2022, Yi Kai Da has been included in the Huimin Insurance (civil affordable insurance scheme) in more than 30 provinces and cities across the country. Fosun Kite will also actively expand the coverage of CAR-T cell therapy treatment centers. As of the end of May, there are more than 80 Yi Kai Da treatment centers on file to meet the needs of nearby treatment for patients with relapsed/refractory large B-cell lymphoma in various provinces and cities.

Fosun’s Happiness Segment Stands the Test of the Epidemic with Promising Recovery and Growth

While the domestic tourism industry is still affected by the volatile epidemic situation, Fosun Tourism Group is accelerating its recovery to a growth trajectory with the strong rebound of its global business and its continuous deployment during the epidemic. Since Fosun Tourism Group announced in April that it has turned profitable in the first quarter of 2022, the turnover of Club Med (Fosun Tourism Group’s subsidiary) in April and May, in overseas has surpassed the pre-pandemic year of 2019 with double-digit growth in the two major regional markets of Europe and the Americas. The successive opening of new resorts such as Club Med Quebec Charlevoix in Canada, Club Med Magna Marbella in Spain, and Club Med Joyview Qiandao Lake in China will also inject new growth impetus for Club Med.

In addition to Club Med, other overseas businesses of Fosun Tourism Group have also made good progress. The century-old travel agency brand, Thomas Cook’s business in the U.K. saw an increase of more than 8-fold year-on-year in the first quarter. Thomas Cook is also actively expanding other regional businesses such as the Netherlands and France. Casa Cook, a high-end hotel and resort brand, opened a new resort, Casa Cook Samos in Greece in May this year, which has already received the Hotel Design Award 2022 presented by PKF Hospitality Group just a month after its opening. As more countries around the world lift travel restrictions, it is believed that Fosun Tourism Group's global businesses will continue fuel growth momentum, offering promising prospects.

Another flagship of Fosun's Happiness segment - Yuyuan Inc., according to its operating results in first quarter of 2022, despite the current wave of epidemic in Shanghai, Yuyuan Inc. continued to expand its business and recorded an operating revenue of RMB12.2 billion, representing a year-on-year increase of 12%, demonstrating good risk tolerance and a solid foundation for development. In the first quarter, its Jewelry & Fashion segment continued to expand its sales channels, and the sales of its “Guyun Gold” series hit a new high, with a year-on-year increase of over 100%. The Yuyuan Jewelry & Fashion chain business opened 140 net stores, bringing the total to 4,121 stores, consolidating its leading position in store expansion in the industry.

In the future, Fosun will protect itself against market risk with a diversified business portfolio, a global asset presence, and the “Profound Industry Operations + Industrial Investment” strategy, and will continue to adhere to strict financial and capital management systems so as to further consolidate the Company's capital foundation. It is well recognized by the market that Fosun International's current valuation is attractive. S&P Global Ratings reaffirmed “stable” outlook for Fosun and recognizes its sound financial structure and abundant cash flow. In addition, Morgan Stanley is bullish on Fosun International, expects the Company's share price to rebound in 60 days and suggests investors to buy Fosun's shares now.

share